Steps in converting to a roth ira.

Back door roth ira conversion deadline.

From there a roth ira conversion takes place letting those high income investors take advantage of tax free growth and future distributions without having to pay income taxes later on.

Roth ira income limits if your annual income is low enough you may.

In order to prepare myself for a backdoor roth conversion i recently rolled over all my non roth ira accounts to my current employer s 401 k to avoid the pro rata rule as well as contributed my annual non deductible 5500 to a tira.

31 of that year.

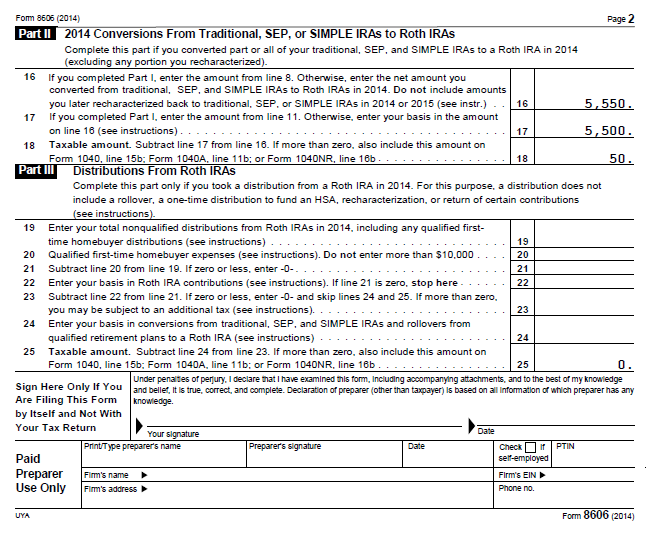

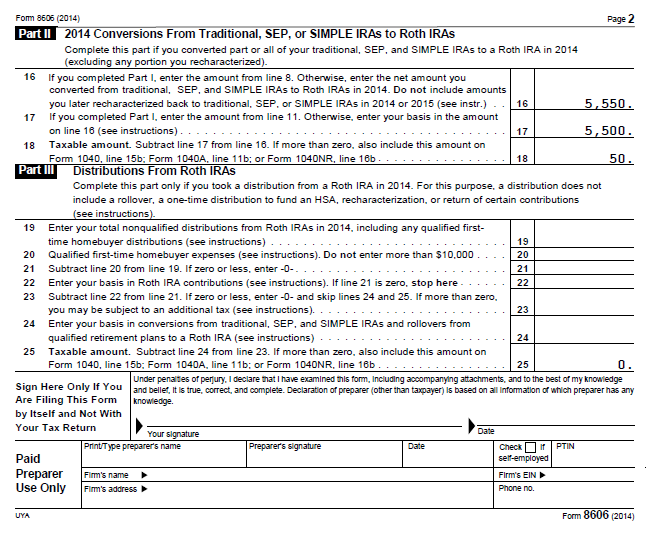

The conversion is reported on form 8606 pdf nondeductible iras.

The deadline for executing a roth ira conversion for a given tax year is dec.

A backdoor roth ira can make sense in the same scenarios any roth ira conversion makes sense.

This can cause some confusion since you generally have until april 15 of the following year to add.

See publication 590 a contributions to individual retirement arrangements iras for more information.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution.

December 31 2019 for the 2019 tax year.

More the complete guide to the roth ira.

The net effect of the backdoor roth ira contribution is that the conversion eliminates the ability to make deductible ira contributions.

Return to iras faqs.

Use the checklist below for your account types or call 800 343 3548 to start the process.

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.